Valens Semiconductor Reports First Quarter 2025 Results

May 7, 2025

Key Financial Highlights:

- Q1 revenues: $16.8 million, exceeding the top end of our guidance.

- Q1 gross margin: 62.9% GAAP; 66.7% non-GAAP.

- Cash, cash equivalents and short-term deposits: $112.5 million.

HOD HASHARON, Israel, May 7, 2025 /PRNewswire/ — Valens Semiconductor Ltd. (NYSE: VLN), a leader in high-performance connectivity, today reported financial results for the first quarter ended March 31, 2025.

“Valens had a positive start to 2025,” said Gideon Ben-Zvi, CEO of Valens Semiconductor. “In ProAV, we’re beginning to emerge from the bottom of the sales cycle, and we’re seeing increasing interest in our solutions from our customers. In the high-growth-potential machine vision market, we showcased our chips at major trade conferences while announcing partnerships with a variety of leading companies in this space. In automotive, the interest in the MIPI A-PHY standard continued to build; after announcing our partnership with Mobileye on our three design wins, we held successful interoperability testing with seven A-PHY silicon vendors. We’re eager to use this momentum to spur us to greater heights in Q2.”

“We’ve rounded out the first quarter of 2025 having, once again, exceeded the top end of our revenue guidance,” said Guy Nathanzon, CFO of Valens Semiconductor. “We believe we are now well positioned to capitalize on the significant business opportunities that lie ahead, across the variety of industries we serve. We have also recently announced another share repurchase program of up to $15 million, reflecting the confidence we have in the company’s long-term growth. Regarding the new tariffs – while it looks like semiconductors are currently exempt, it is still too early to estimate the direct impact on our operations and the impact on our customers’ end-market demand. We are monitoring developments closely and will communicate once we have better visibility.”

Q1 2025 Financial Highlights:

- Q1 revenues reached $16.8 million, exceeding our guidance of $16.3-$16.6 million, compared to $16.7 million in Q4 2024 and $11.6 million in Q1 2024.

– Q1 Cross-Industry Business (“CIB”) revenues, accounted for approximately 70% of total revenues at $11.7 million compared to $11.7 million dollars in Q4 2024 and $7.2 million in Q1 2024.

– Q1 Automotive revenues accounted for approximately 30% of total revenues at $5.1 million, compared to $5.0 million dollars in Q4 2024 and $4.4 million in Q1 2024.

- Q1 GAAP gross margin was 62.9% (non-GAAP gross margin was 66.7%), above the guidance. This is compared to a GAAP gross margin of 60.4% for Q4 2024 and 59.0% for Q1 2024 (non-GAAP gross margin of 64.5% in Q4 2024 and 62.0% in Q1 2024). On a segment basis, Q1 gross margin from the CIB was 69.1% and gross margin from Automotive was 48.4%. This compares to a Q4 2024 gross margin of 64.7% and 50.5%, respectively, and a Q1 2024 gross margin of 77.2% and 29.1%, respectively. The increase in Q1 automotive gross margin compared to Q1 2024 was due to an optimization of our product cost. The increase in gross margin of the CIB compared to Q4 2024 was due to an inventory adjustment in Q4 2024.

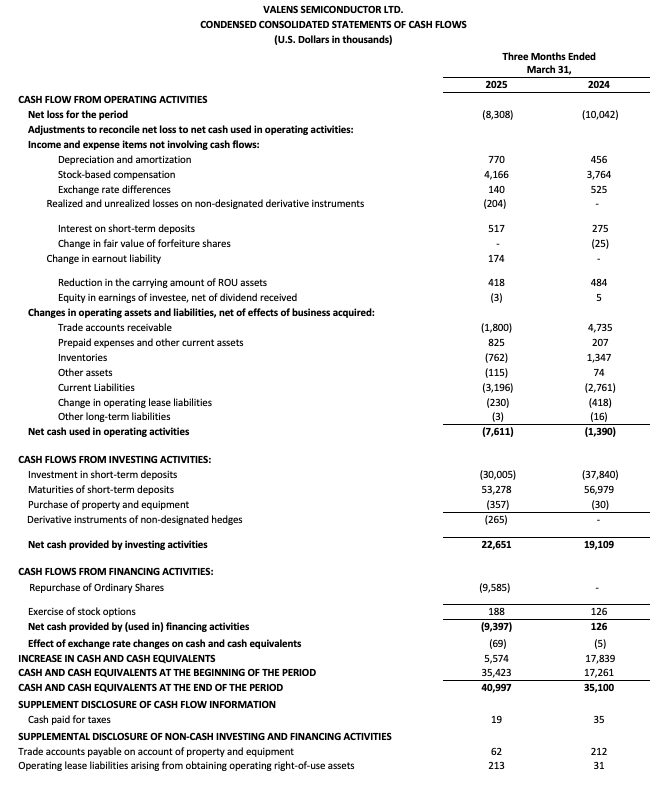

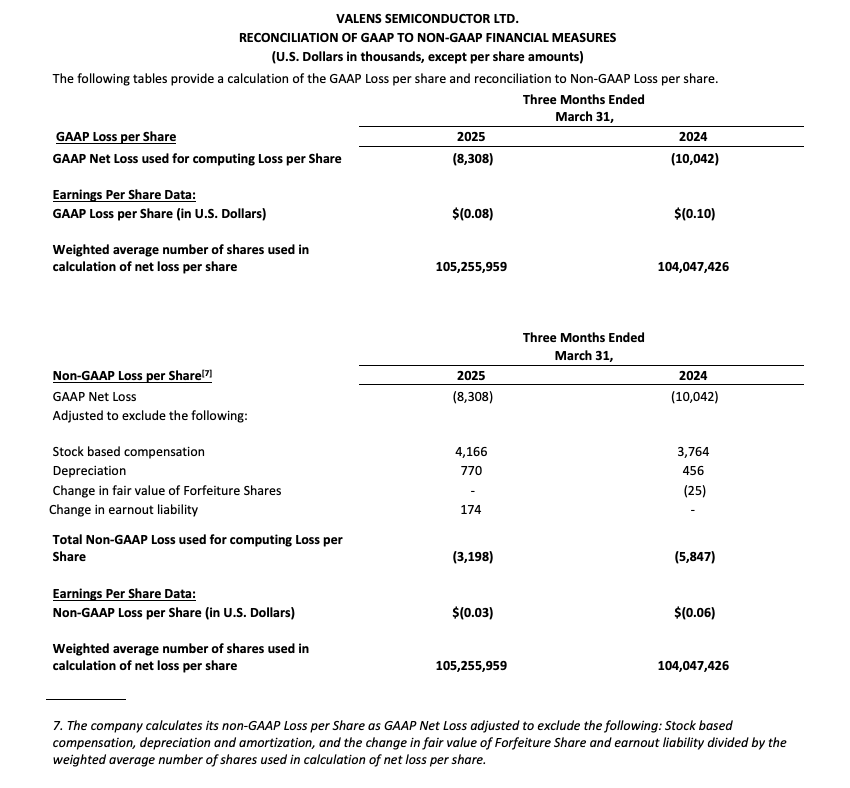

- Q1 GAAP net loss amounted to $(8.3) million, compared to a net loss of $(7.3) million dollars in Q4 2024 and a net loss of $(10.0) million dollars in Q1 2024.

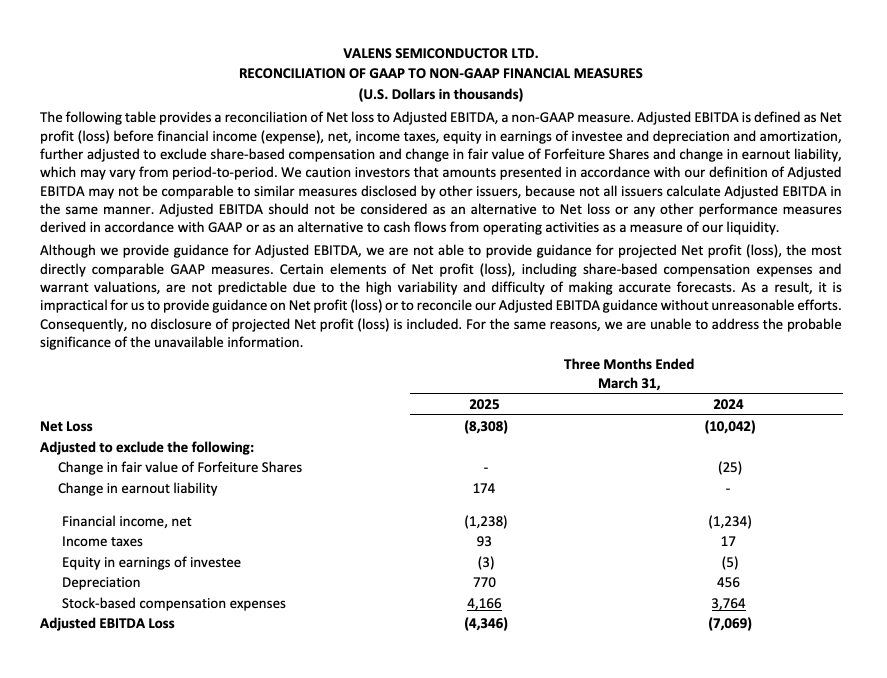

- Q1 adjusted EBITDA was a loss of $(4.3) million, within the guidance range of $(4.5)-$(4.2) million EBITDA loss. This compares to an adjusted EBITDA loss of $(3.7) million dollars in Q4 2024 and an adjusted EBITDA loss of $(7.1) million dollars in Q1 2024.

- Cash balance as of March 31, 2025, was $112.5 million. This compares to a cash balance of $131.0 million as of December 31, 2024. During the first quarter of 2025 the company used $9.6 million for the share repurchase programs, announced in December 2024 and in February 2025.

Q1 2025 Business Highlights:

- Received endorsement from Sennheiser for our extension technology to use with the company’s TeamConnect Bar solutions

- Partnered with RGo Robotics and CHERRY Embedded Solutions to design optimized AI robotic systems

- In April, announced that Valens’ VA7000 MIPI A-PHY-compliant chipsets will form the in-car, sensor to compute connectivity infrastructure for Mobileye EyeQ™6 High automated and autonomous production programs underway with a group of global automotive brands

- Successfully completed product interoperability testing with seven MIPI A-PHY silicon vendors to advance the standard ecosystem in China and globally

- Announced a new share repurchase program of $15 million, which was launched on March 17, 2025. During the first quarter of 2025 the company completed the first repurchase program of $10 million announced in December 2024

Financial Outlook for Q2 2025

For Q2 2025, Valens Semiconductor expects revenues to range between $16.5 million and $16.8 million, gross margin to range between 63.0% and 64.0%, and adjusted EBITDA loss to range between $(4.9) million and $(4.4) million.

Disclaimer: Valens Semiconductor does not provide GAAP net profit (loss) guidance as certain elements of net profit (loss), including share-based compensation expenses and warrant valuations, are not predictable due to the high variability and difficulty of making accurate forecasts. Adjusted EBITDA is a non-GAAP measure. See the tables below for additional information regarding this and other non-GAAP metrics used in this release.

Conference Call Information

Valens Semiconductor will host a conference call today, Wednesday, May 7, 2025, at 8:30 a.m. Eastern Time (ET) to discuss its first quarter 2025 financial results and business outlook. To access this call, dial (at least 10 minutes before the scheduled time) +1 (888) 281-1167 (U.S.), 0 (808) 101-2717 (UK), 03 918 0610 (Israel) or +972 3 918 0610 (all other locations). A live webcast of the conference call will be available via the investor relations section of Valens Semiconductor’s website at Valens – Financials – Quarterly Results. The live webcast can also be accessed by clicking here. A replay of the conference call will be available on Valens Semiconductor’s website shortly after the call concludes.

NYSE Rule 203.01 Annual Financial Report Announcement

Pursuant to Rule 203.01 of the New York Stock Exchange Manual, Valens Semiconductor Ltd. hereby announces to holders of its ordinary shares that its Annual Report on Form 20-F for 2024 (including its full year 2024 audited financial statements), filed with the U.S. Securities and Exchange Commission on February 26, 2025, is available in the investor relations section of its website at https://investors.valens.com/financials/secfilings/default.aspx. While the company encourages the sustainable approach of downloading and reading the report online, hard copies of the 2024 Annual Report will be provided free of charge, upon request, as follows: Valens Semiconductor Ltd., 8 Hanagar St. POB 7152, Hod Hasharon 4501309, Israel, or by emailing: investors@valens.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding our anticipated future results, including financial results, our five-year plan, currency exchange rates, and contract wins, and future economic and market conditions. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Valens Semiconductor’s (“Valens”) management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Valens Semiconductor. These forward-looking statements are subject to a number of risks and uncertainties, including the cyclicality of the semiconductor industry; the effect of inflation and a rising interest rate environment on our customers and industry; the ability of our customers to absorb inventory; competition in the semiconductor industry, and the failure to introduce new technologies and products in a timely manner to compete successfully against competitors; if Valens fails to adjust its supply chain volume due to changing market conditions or fails to estimate its customers’ demand; disruptions in relationships with any one of Valens’ key customers; any difficulty selling Valens’ products if customers do not design its products into their product offerings; Valens’ dependence on winning selection processes; even if Valens succeeds in winning selection processes for its products, Valens may not generate timely or sufficient net sales or margins from those wins; sustained yield problems or other delays or quality events in the manufacturing process of products; our ability to effectively manage, invest in, grow, and retain our sales force, research and development capabilities, marketing team and other key personnel; our ability to timely adjust product prices to customers following price increase by the supply chain; our ability to adjust our inventory level due to reduction in demand due to inventory buffers accrued by customers; our expectations regarding the outcome of any future litigation in which we are named as a party; our ability to adequately protect and defend our intellectual property and other proprietary rights; our ability to successfully integrate or otherwise achieve anticipated benefits from acquired businesses; the market price and trading volume of the Valens ordinary shares may be volatile and could decline significantly; further deterioration of macroeconomic conditions due to ongoing global political and economic uncertainty, including with respect to China-Taiwan relations and increasing trade and other tariff-related tensions (as our current guidance assumes the estimated production and/or demand impact on us of current tariff conditions); political, economic, governmental and tax consequences associated with our incorporation and location in Israel; and those factors discussed in Valens’ Form 20-F filed with the SEC on February 26, 2025 under the heading “Risk Factors,” and other documents of Valens filed, or to be filed, with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Valens does not presently know or that Valens currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Valens’ expectations, plans or forecasts of future events and views as of the date of this press release. Valens anticipates that subsequent events and developments may cause Valens’ assessments to change. However, while Valens may elect to update these forward-looking statements at some point in the future, Valens specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Valens’ assessment as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

About Valens Semiconductor

Valens Semiconductor is a leader in high-performance connectivity, enabling customers to transform the digital experiences of people worldwide. Valens’ chipsets are integrated into countless devices from leading customers, powering state-of-the-art audio-video installations, next-generation videoconferencing, and enabling the evolution of ADAS and autonomous driving. Pushing the boundaries of connectivity, Valens sets the standard everywhere it operates, and its technology forms the basis for the leading industry standards such as HDBaseT® and MIPI A-PHY. For more information, visit https://www.valens.com/.

For more information, please contact:

Michal Ben Ari

Investor Relations Manager

Valens Semiconductor Ltd.

michal.benari@valens.com

Miri Segal

MS-IR IR for Valens

msegal@ms-ir.com

Media Contact:

Yoni Dayan

Head of Communications

Valens Semiconductor Ltd.

yoni.dayan@valens.com